There she goes again. The Runs seems to have another bout of j’accuse-itis. Apparently this blog that is either “boring” or “unnoticed” also operates on the basis of envy and is suddenly object of another spat of diarrhoea on the site that never stops the pink tirades. I still do not get the “envy” bit though… I don’t exactly see what there is to envy exactly. God knows…. although I’m sure even He would have some difficulty fathoming the character assessments on The Runs.

Anyways, it turns out that some bloke who (surprise, surprise) posts anonymously on the Runs under the name of Delacroixet had also come across Nikita’s not so hidden ouvre d’art. The Run Fan put up two links to compare and contrast – one to Nikita’s blog and another to a CNBC copy of the FT article. Somehow I am supposed to have “filched” the incredible and news that Nikita’s blog was plagiarised and “not attributed” this fact to the Runs and its followers (by the way, the Runs author is still moping about the “nerd attack” a while back when she was told off by most that her practice of not attributing sources is just not done). Funny, I never came across the CNBC site – it was easier to find the article directly on the Financial Times.

The Nikita business has put quite a few people in a fix. On the one hand these people would like to think that this blog does not exist and that nobody ready it while on the other hand they were itching to report the Nikita business. On the one hand they’d love to say that anyone with a head on their necks could tell that Nikita’s job was outsourced but on the other hand they find it hard to see that one did not necessarily have to dredge through the muck on the Runs to discover the latest example of plagiarism.

If we did not have a track record of noting plagiarism in the papers we’d be worried. Only we know better than the fanatics and bitching fools on a site ridden with grudges. You begin to understand the envy bit when you see the uncontrolled reaction complete with sorry innuendos and banale double-entendres that you only find on www.tasteyourownmedicine.com or www.daphnecaruanagalizia.com. In the nineties we had Manuel Cuschieri, now we have the hammalli peddling their crazed theories from Bidnija to London. Plus ca change…

And in case you thought the Bidniija Blog was serious about the attribution business just look two posts back. While the Runs was still blogging about our discovery (probably eating her heart out based on whatever standards of “I’m first” count as honour in that sad corner of the blogging world) there was no link to this site.

The Runs is right. It’s not about attribution is it. It’s about envy. I still don’t know who the Maltese prick drinking the coffee in the pic she filched from my blog is though. He probably reads the Runs and finds base innuendos extremely funny.

Sorry to disappoint the Runs and the tarzanelli fans but it did not take much to discover Nikita’s filching. Like it had not taken much to find others before. The fact that someone who posts regularly on Runs also notice the plagiarizing only goes to show how ANYBODY could have found it.

BTW Re my supposed obsession with the runs… I’ve said it all before… seems like it’s time for a healthy reminder: Sleeping Bitches & Galliano

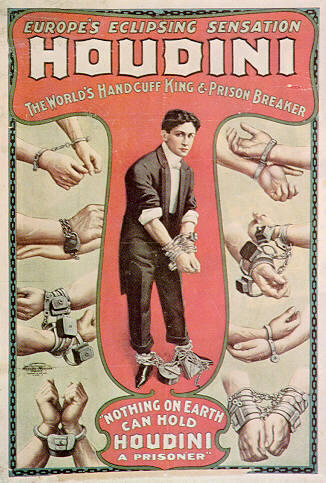

Photo: Some people go green with envy. This one prefers shades of red (taken from www.tasteyourownmedicine.com).